AML | Risk Assessment | FCRA | KYC | Fraud| | Payment Fraud |Regulatory Risk |Sanctions

DataFrame Solution is a company in the field of AML/CFT compliance and Fraud detection and prevention powered by data analytics and decision science, Machine Learning, and Artificial Intelligence. We do what is required to help a business to make better compliance decisions and improve ROIs.

AML/CFT

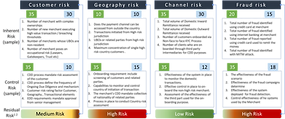

With increasing regulatory scrutiny and rapidly evolving financial crime threats, it is now more crucial than ever for Financial Institutions to stay ahead of the curve by closely monitoring the latest AML compliance trends and predictions. Data driven decision making processes are replacing the erstwhile judgement based risk identification and monitoring. We assist Financial Institutions to utilize advance analytics and leverage the vast amount of data to identify patterns and trends indicative of money laundering or terrorism financing activities. This data driven approach will enable you to make more informed decisions, allocate resources more efficiently and better manage financial crime risks.

Fraud

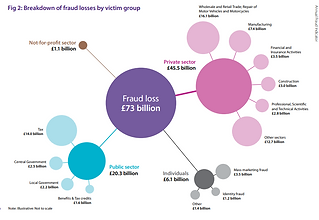

Fraud is growing relentlessly. According to a report published by ACFE, upto 5% of corporate revenue is lost to Fraud every year, which is estimated to $4.7 Trillion globally. With our cutting edge and easily deployable AI/ML based Fraud detection solution you can help you prevent these frauds even before they occur.

Data Science

Financial Institutes can apply Machine Learning (ML) and Artificial Intelligence(AI) across AML value chain. ML algorithms such as Random Forest, Gradient Boosting, Deep learning etc. can be used across Transaction Monitoring (TM), Onboarding and Dynamic Risk assessment to reap immediate benefits.