DataFrame Solution provides a suite of products and services to counter Fraud and Money Laundering.

The Products are designed in parallel global industry standard framework to counter Fraud and Financial Crime. The Products are highly customizable and built in collaboration with Industry experts and regulators. Every work has a pre-requisite component of risk assessments, which give the institution an insight into the risk they are exposed to. DataFrame Solution has a Libraray of more than 1,000+ risk indicators spans Fraud and Financial crime risk.

FCRA

Financial Crime Risk Assessment

FCRA is a process of identifying, analyzing, and evaluating the Financial crime risk associated with the institution's line of business. The goal of FCRA is to help organizations understand their exposure to FC risks like money laundering, terrorist financing, sanction evasion, and fraud. iFCRA is an automated tool with an integrated workflow that can be customized to meet an organization's FCRA requirement. The tool has an inbuilt dashboard to provide YoY Inherent/Control/Residual risk for the organization or for a particular Assessment unit.

Fraud Risk

Fraud Risk Assessment

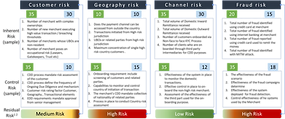

Fraud risk assessment helps an institution figure out how likely it is for people to do dishonest things inside and outside the company. Inside the company, dishonest actions could be taking money or things that don't belong to them. Outside the company, it might be things like breaking into computer systems or stealing company secrets.

A fraud risk assessment can be done in different ways. DataFrame solution experts comprehensively assessed the existing fraud framework, system, and control. It's important to provide insight into the level of fraud risk an institution is exposed to. It is important to put safeguards in place against fraud. The institution should focus on the fraud risks that are specific to the nature and business of the institution.

AML Transaction Monitoring

Scenario Development

Transaction monitoring capability of a Financial Institution is the backbone of AML CFT surveillance. The purpose of transaction monitoring is to detect suspicious activities such as money laundering, terrorist financing, fraud, and other financial crimes. Though there are standard products available for Transaction monitoring, the customization of rules according to the institution's risk profile and product offering is crucial. In absence of customization, the rules may fail to capture institution-specific risks and potentially result in missed suspicious activities.

Dataframe solution will assist a Financial Institution by developing a unique set of monitoring scenarios, which not only cover the known typologies in the jurisdiction but also tailor made to Financial Institution risk profile. We will assist, analyze and recommend to you the correct set of scenarios based on your customer types, product profile and transactional patterns. This optimization will allow you to focus on risks which are material in nature and require your utmost attention.

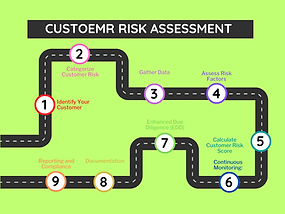

Customer Risk Assessment

Assessment

To facilitate comprehensive due diligence and be able to do business with a customer while ensuring the risk remains within the Financial Institution's risk appetite, a customer risk assessment process is employed to evaluate the level of risk presented by the customer. Customer risk rating coupled with appropriate risk approval matrix provides assurance to senior management that risks arising from new customers are identified, reviewed and mitigated.

Dataframe solution will assist you in setting up a risk assessment framework which will identify and factor customer's risk using multiple factors. These ratings will not be a one time assessment of customer risk but will change dynamically based on customer transaction history, change in behaviour or change in risk parameters. The weightages defined for each risk type will be statistically derived and cater to the customer's specific customer base.

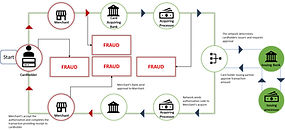

Payment Fraud

Detection

As of June 2018, 63% of businesses worldwide reported experiencing at least as much loss because of Fraud through online payment channels during the past year as they did the previous year*.

Example of type of Payment Fraud

- Identity Theft

- Friendly Fraud

- Clean Fraud

- Merchant Identity Fraud

In fraud detection and prevention, data mining involves categorizing, grouping, and segmenting data to autonomously identify correlations and noteworthy patterns, particularly those associated with fraudulent activities. Within the context of fraud detection, neural networks execute tasks such as classification, clustering, generalization, and prediction using data related to fraudulent activities. These predictions can then be compared to findings from internal audits or official financial records. DataFrame Solution has more than 400+ Fraud rules, and with the help of Fraud Risk assessment, Fraud investigator experts, and Machine Learning Models, it will help to detect and reduce Fraud.

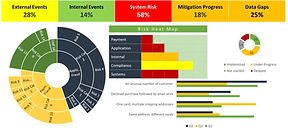

Fraud and TM Alerts

Tuning and Optimization

Instituions need to be agile to respond to threats and embrace new approaches and technologies to predict and prevent fraud. Fraudsters are becoming more sophisticated and can quickly change and adapt their approaches.

With our cutting-edge and easily deployable AI/ML fraud prevention solution, you can be rest assured.

Recent money laundering trends can be classified into four categories: the financial system, trade-based money laundering, real estate, and virtual currency. Although virtual currency is hotly discussed, the three former categories remain by far the most prevalent sources of money laundering.

With our advanced ML algorithm-based solution, the false positive rate in Transaction Monitoring, Dynamic Customer Risk assessment, Trade based ML, and Correspondent banking can be reduced significantly, so that analysts can focus on more productive alerts.